A Guide to Your Tufts Financial Aid Package

Congratulations! You’ve been accepted to Tufts and we are so thrilled to have you! After the initial excitement faded, you might have gone to check your financial aid package to see if we would be an affordable option for you and your family. If you’re anything like me, your first thought might have been—Wait, what’s work study? Who’s charging me for indirect costs? Are books really $1,000??

I advise you, first, to take a breath—it will all make sense soon! Ideally, sit down with a parent, guardian, or school counselor to help parse through your financial aid package and what it means for you. As you do, I hope this guide can help you navigate your financial aid package from Tufts and give you a clearer picture of the financial side of your college decision.

Here’s an example of a possible Tufts financial aid package:

While each award looks different and might not have everything featured here, this includes most of the possibilities. Let's break it down!

Total Cost of Attendance

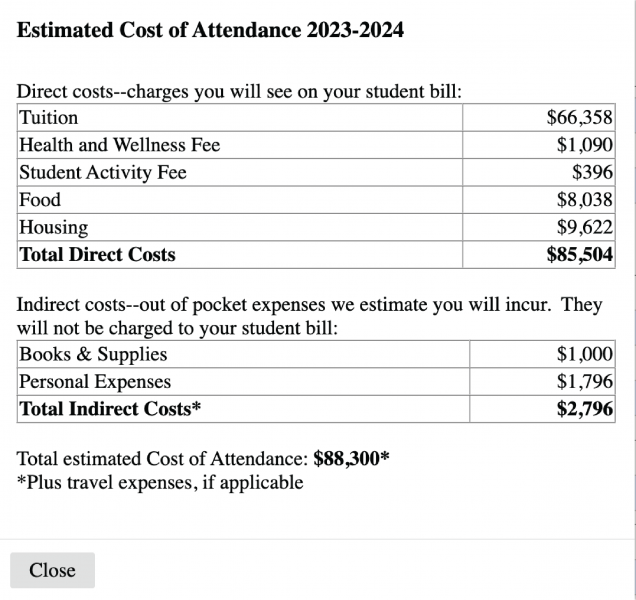

Here is a breakdown of the standard cost of attendance, which is linked to your letter in your Tufts applicant portal.

Notice that there are direct and indirect costs. As noted in the image above, direct costs will be part of your student bill, whereas indirect costs are not billed by the university, but are costs that you’re estimated to incur as a student. Let me say that again: indirect costs are an estimate. Students may spend less or more, depending on many factors. So, no, books themselves aren’t necessarily $1,000—you’ll likely be able to find some used ones for sale, or you can rent them to save money. Even if you choose to buy new books, it’s possible your books for the year might cost far less—textbooks and their cost will vary widely by class. You may find it helpful to build a more personalized estimate of indirect costs to better manage your budget. Keep in mind the cost of travel to Tufts from your home, and any big expense items you might want or need to purchase, such as a laptop.

Family Contribution

Your family contribution is not necessarily what you owe Tufts, but rather what the financial aid office has determined to be the amount you and your family are able to contribute towards both direct and indirect costs. You’ll notice in comparing the two images above that the total of the direct costs is $85,504, and the total sum listed of the financial aid award is $80,645. That means that the remaining direct cost to be paid by the student and family is $4,856, which you’ll note is less than the Family Contribution, which is listed as $8,200. The expectation in this circumstance is that some of that family contribution will go towards indirect costs.

Need

This is an estimate of how much you will need in aid. Note that it’s not always going to be the same number as the total of the aid award—Indirect costs are responsible for some of that gap, but generally your aid award should closely reflect the need that is estimated.

The Package

This section contains multiple parts that make up your Tufts financial aid award, and since each part functions a bit differently, I’ll break each section down. Note that there are two columns, one for Fall and one for Spring. This is because you will get billed once for each semester, and each time you will be paying half of the total direct cost. Alternatively, there is an option to pay through a monthly payment plan, if that is preferable to you.

Grants

A grant is money that you do not have to pay back. In this example, there are three different grants being offered—each award might have different grants listed, but the important thing is that all grants are money being applied directly to your account balance. One thing to note is that the grants might come from different places. A ‘Tufts Grant’ is provided by Tufts itself, the Federal Pell Grant comes from the US government, for which eligibility is determined by FAFSA, and there are other smaller grants from the state and federal government that students might qualify for based on their financial aid application, as is the case in this example.

Loans

A loan is money that will need to be repaid, along with interest. Just because a loan is offered in your financial aid award does NOT mean that you need to agree to take out the loan in order to attend Tufts—it is there as an option for you, should you require it. While not everyone will have loans in their Tufts Financial Aid package, any listed loan amount should be under the yearly federal loan limit, which is $5,500 for first-year, dependent students. No more than $3,500 of that amount may be in subsidized loans, which do not accrue interest during college. There are different limits for students that FAFSA designates as independent, and differences between subsidized and unsubsidized loans—you can learn more about federal loans on the FAFSA website. It’s important to do thorough research prior to agreeing to take out a loan, to ensure that you understand what repayment will look like for you!

Work Study

Work study money does not get applied to your bill. Rather, it is money provided by the federal government directly to the college and can only go to the student in the form of a paycheck from a work study job at their college. The idea behind work study is that it can help students deal with direct or indirect costs throughout the school year by providing them with easier access to income at their college.

An important thing to note is that while it is included here in the ‘Total Award’ amount, it is money that will go to you through employment and therefore will not be applied to direct costs like everything else listed in the award section. You could certainly save and use the money in that way, but you might find that it makes more sense for you to use the income to support your indirect costs. Another important note is that while you do not have to get a work-study job, you will not receive any work-study money unless you do so.

There are many, many work study jobs available on campus, and for that matter many that can be work study or non work study, so finding a job shouldn’t be a problem once you get on campus. That being said, hiring often starts immediately in the fall semester, so start looking for listings right away on Handshake, the service that Tufts uses to help students find employment on or off campus. You can read more about student employment here. Work study jobs range widely in type, from monitoring a front desk to working in a dining hall, so keep in mind what kind of work you might be interested in and what will fit best in your schedule!

Whew! That covers everything in your Tufts financial aid package! If you’re an admitted student with more questions, you can check this page from the Financial Aid Office, and reach out to Student Services at 617-627-2000 or email studentservices@tufts.edu directly if your questions are specific to your unique financial circumstances.